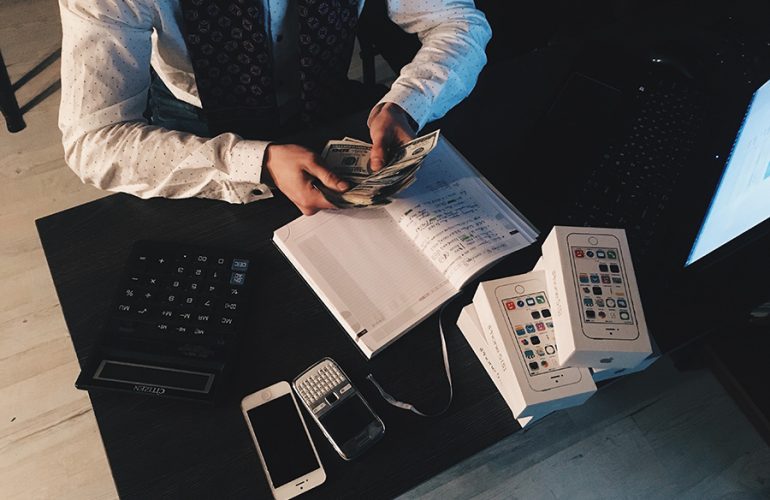

Mineral rights ownership can be a lucrative investment, providing individuals with the opportunity to capitalize on the wealth beneath their land. For those considering selling their mineral rights, the year 2024 holds significant promise. This article delves into the factors that make 2024 a potentially advantageous year to sell mineral rights.

Rising Demand for Natural Resources: One of the primary drivers for selling mineral rights is the ever-increasing global demand for natural resources. As economies continue to grow, the need for minerals and energy resources becomes more pronounced. With the world gradually recovering from the economic downturn of recent years, the demand for minerals is expected to rise steadily. This increased demand can translate into higher prices, providing an opportune moment for mineral rights owners to secure favorable deals.

Technological Advancements in Extraction: The technological landscape of mineral extraction is evolving rapidly, with innovations enhancing efficiency and reducing costs. Advanced extraction techniques, such as hydraulic fracturing and directional drilling, have made it possible to access previously untapped reserves. This technological progress not only increases the overall value of mineral rights but also attracts more buyers interested in leveraging these cutting-edge methods. Consequently, sellers in 2024 may find themselves in a more competitive market, driving up the value of their mineral rights.

Environmental and Regulatory Changes: The global shift towards sustainable practices and renewable energy sources has prompted governments to reevaluate their environmental policies. As a result, some mineral-rich areas may face stricter regulations, impacting extraction activities. Sellers in 2024 may benefit from heightened interest from buyers seeking to secure rights in regions with less stringent regulations, creating a favorable environment for negotiations.

Economic Recovery and Investment Appetite: The year 2024 is poised for economic recovery following the challenges posed by recent global events. As economies rebound, the appetite for investments in various sectors, including natural resources, is likely to grow. Investors seeking stable and long-term returns may be more willing to enter into agreements for mineral rights, potentially leading to more competitive offers for sellers.

Predictable Market Conditions: The mineral rights market can be influenced by various factors, including geopolitical events, economic fluctuations, and regulatory changes. However, 2024 is expected to be a year of relative stability, providing sellers with a more predictable environment for making informed decisions. This stability can contribute to a smoother sales process and help sellers secure favorable terms.

Diversification and Portfolio Optimization: Individuals with diverse investment portfolios may consider selling mineral rights as a strategic move to optimize their overall financial standing. By liquidating mineral rights in 2024, sellers can unlock capital and allocate resources to other investment opportunities that align with their financial goals and risk tolerance.

In conclusion, the confluence of factors makes 2024 a potentially opportune year for selling mineral rights. From the increasing global demand for natural resources to advancements in extraction technologies and a more stable economic environment, sellers may find themselves in a favorable position to maximize the value of their mineral rights. However, it’s crucial for individuals to conduct thorough research, seek professional advice, and carefully evaluate offers to make informed decisions that align with their financial objectives. As with any investment decision, timing and strategic planning are key components of success in the dynamic landscape of mineral rights transactions.

If you’re looking to to sell your mineral rights in 2024, call Ten Cow Holdings at (210) 960-1564. We will guide you through the entire process to ensure a smooth and profitable transaction.