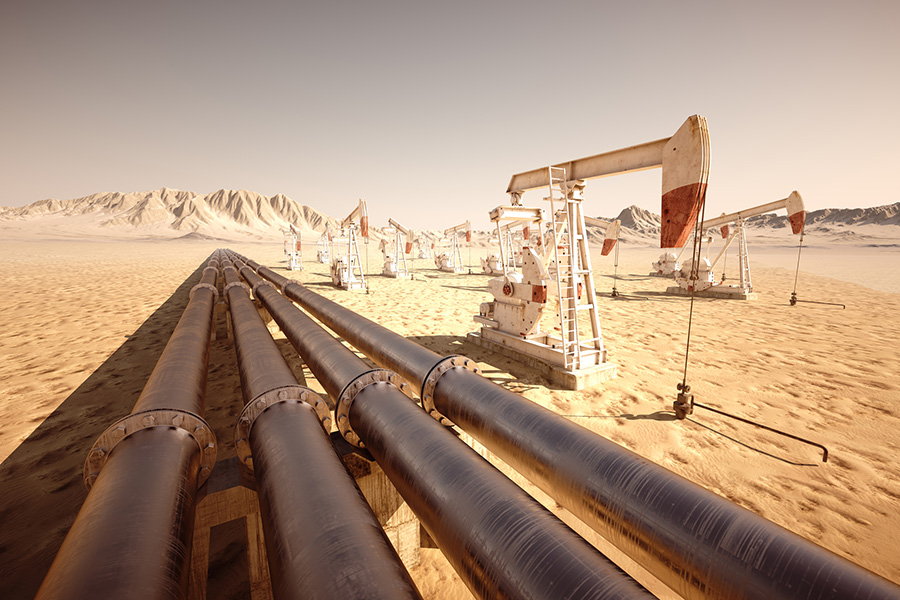

Geological surveys play a pivotal role in the assessment of mineral rights value, serving as a cornerstone for informed decision-making in the mineral rights industry. These surveys provide critical data and insights into the geology of a prospective area, enabling mineral rights owners, investors, and companies to evaluate the potential for mineral extraction and determine the worth of their assets. In this article, we delve into the importance of geological surveys in assessing mineral rights value, exploring the methodologies, technologies, and key considerations involved.

Understanding Geological Surveys

Geological surveys involve the systematic study and analysis of the Earth’s geological features, including rock formations, mineral deposits, and subsurface structures. These surveys employ various techniques and tools to gather data, ranging from geological mapping and remote sensing to geophysical surveys and drilling.

One of the primary objectives of geological surveys is to identify and delineate mineral deposits within a given area. This process entails mapping the distribution and characteristics of geological formations, such as sedimentary layers, igneous intrusions, and fault lines, which may host valuable mineral resources. By analyzing the geological history, structure, and composition of an area, geologists can infer the likelihood of mineralization and assess its economic potential.

Geological surveys also involve the collection and analysis of rock and soil samples to determine their mineral content and properties. Geochemical analysis, including spectroscopy and assay testing, provides valuable insights into the presence and concentration of target minerals, such as gold, copper, or oil, within the surveyed area. These analytical techniques help quantify the mineral potential and guide exploration efforts.

Role in Assessing Mineral Rights Value

Geological surveys are indispensable tools for assessing the value of mineral rights, as they provide crucial information for estimating reserves, predicting extraction costs, and evaluating investment returns. Here are some key aspects of how geological surveys contribute to the assessment of mineral rights value:

- Reserve Estimation

Geological surveys form the basis for estimating mineral reserves, which represent the economically recoverable portion of a mineral deposit. By delineating the extent, grade, and continuity of mineralization through geological mapping and sampling, geologists can quantify the volume of reserves within a given area. This information is essential for valuing mineral rights, as it directly influences the potential revenue streams and investment attractiveness of the asset.

- Risk Assessment

Geological surveys help identify geological risks and uncertainties associated with mineral exploration and extraction. Geologists assess factors such as geological complexity, mineralization depth, and deposit geometry to evaluate the technical and operational challenges involved. Understanding these risks is critical for investors and mineral rights owners to make informed decisions and mitigate potential losses.

- Economic Viability

By integrating geological data with economic parameters, such as commodity prices, extraction costs, and regulatory considerations, geological surveys enable stakeholders to assess the economic viability of mineral projects. Geologists evaluate factors such as deposit size, grade distribution, and metallurgical characteristics to determine the potential profitability and investment feasibility of mineral rights. This analysis is essential for optimizing resource development strategies and maximizing asset value.

- Exploration Targeting

Geological surveys play a crucial role in exploration targeting, helping identify prospective areas for mineral discovery. By interpreting geological maps, geophysical surveys, and geochemical data, geologists can prioritize exploration targets based on their geological favorability and prospectivity. This focused approach minimizes exploration risks and enhances the efficiency of mineral exploration programs, ultimately increasing the value proposition of mineral rights.

Technological Advances and Innovations

Advancements in technology have revolutionized the field of geological surveys, enabling more precise and cost-effective exploration techniques. Remote sensing technologies, such as satellite imagery and aerial LiDAR, facilitate regional-scale mapping and reconnaissance, allowing geologists to identify geological features and anomalies from a bird’s-eye view. Additionally, geophysical methods, including electromagnetic surveys and ground-penetrating radar, provide valuable subsurface information without the need for extensive drilling.

Furthermore, digital mapping and Geographic Information Systems (GIS) have streamlined data management and visualization, allowing geologists to integrate multidisciplinary datasets and analyze spatial relationships more effectively. This integration of data enhances the accuracy of geological interpretations and decision-making processes, contributing to more robust assessments of mineral rights value.

In conclusion, geological surveys play a fundamental role in assessing the value of mineral rights by providing essential data and insights for resource evaluation, risk assessment, and exploration targeting. By leveraging advanced technologies and analytical techniques, geologists can delineate mineral deposits, estimate reserves, and evaluate economic viability with greater precision and efficiency. For mineral rights owners, investors, and companies, understanding the role of geological surveys is paramount in unlocking the full potential of their mineral assets and optimizing investment outcomes in the dynamic mineral rights market.

If you’re looking for more information to asses the value of your mineral rights, please call Ten Cow Holdings at (210) 960-1564. We will be happy to make sure you get the info you need to make the most informed decision.